The Panic of 1907 was preceded by a time of fortune and prosperity. Citizens were still reaping the benefits of striking gold years before (, and the U.S. railroad system was booming, exporting materials across the country. Similar to the Financial Crisis of 1857 which also involved tightened federal railroad regulation, the Panic rose from the inner depths of investing in stocks, more specifically, cornering shares of railroad and mining companies. Railroad rates were fixed through legislations such as the Railroad Rate Bill and the Hepburn Act. These were put into place to eliminate economic discrimination so that the more affluent shareholders did not hold too much power over the entities dominating the market. However, this did not bode well for the wealthy and powerful such as J.P. Morgan, for example, who invested heavily in railroad securities at the time.

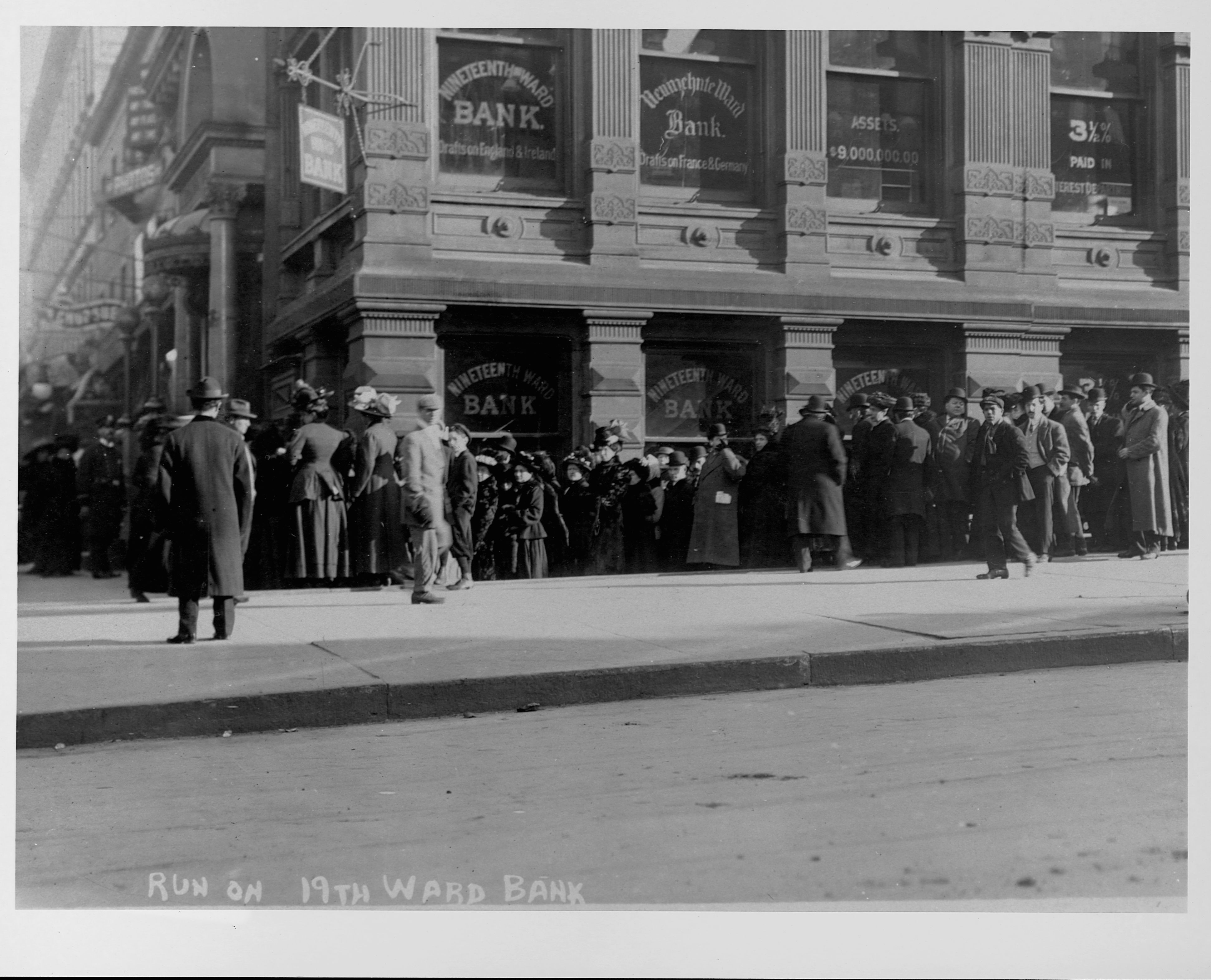

Moreover, the economy was just bouncing back with its prices and industries considering the damage caused by the Panic of 1893 (another banking crisis). Public confidence was still being regained, so these sudden strictures incited people who were already on edge regarding their money to act fast. Shadow banks at the time, namely trust companies, were very prevalent and pervasive, especially in New York. On October 22, the stock market plummeted following the run on the Mercantile National and Knickerbocker Trust Company. After the National Bank refused to emergency assist these companies due to disreputable actions of a few of the previously mentioned wealthy men, public distrust rose as there was a mass liquidation of assets before the trusts went down under. However, the U.S. Treasury received gold from France in return for purchase of securities in November after the frenzy in October. This is said to have helped the money crisis.

Long term consequences should not go unnoticed as there was a resulting significant recession in which international economies were affected by railroad bonds that were traded in France and London. The setback impacted the people’s lives through a rise in unemployment and interest rates and a drop in production, imports, and immigration. It took even longer now to regain public confidence and trust.

The Panic of 1907 is not considered much since it was overshadowed by the Panic of 1893 and the Great Depression, but this in between occurrence highlighted severe instability concerning the U.S. economy as well as the global market. This event served as a downfall moment felt nationally and as a wider opening for more disaster to come (the Great Depression).

Works Cited

Frydman, Carola, Hilt, Eric, Zhou, Lily. "Economic Effects of Runs on Early 'Shadow Banks': Trust Companies and the Impact of 1907." The Journal of Political Economy, vol. 123, no. 4, pp. 902-940, 2015. Purdue Libraries. https://web-s-ebscohost-com.ezproxy.lib.purdue.edu/ehost/detail/detail?vid=0&sid=614dbe5a-f1f7-4fd4-9202-75af55da09bf%40redis&bdata=JnNpdGU9ZWhvc3QtbGl2ZQ%3d%3d#AN=108825128&db=bth

Rodgers, M.T. & Wilson, B.K. "Systemic risk, missing gold flows and the panic of 1907." The Quarterly Journal of Austrian Economics, vol. 14, no. 2, pp. 158+, 2011. Purdue Libraries. https://go.gale.com/ps/i.do?p=AONE&u=purdue_main&id=GALE%7CA267519028&v=2.1&it=r

Edwards, Adolph. “The Roosevelt Panic of 1907.” 1907. Purdue Libraries. https://babel.hathitrust.org/cgi/pt?id=hvd.32044020023347&view=1up&seq=4